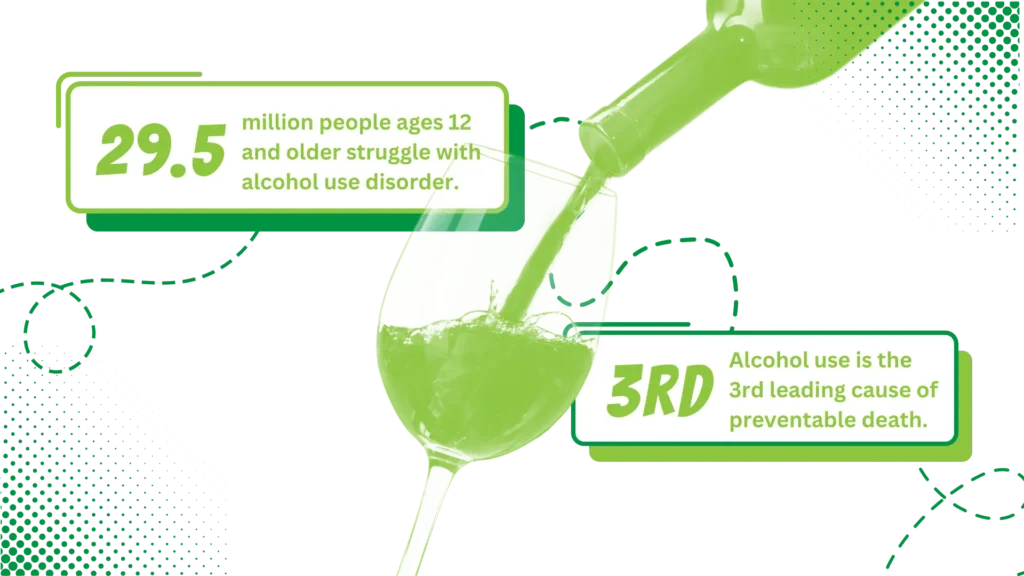

Alcoholism, also known as alcohol use disorder (AUD), affects millions of people across the country each year. According to a 2022 survey, 29.5 million people ages 12 and older had AUD in the year prior. In North Carolina, excessive alcohol use is the third leading preventable cause of death – with over 6,300 deaths in the state in 2021.

For individuals looking to get sober, one of the biggest obstacles they have to overcome is paying for alcohol rehab. The first step to covering the costs associated with alcohol rehab is to check with your insurance provider. Mental health, more specifically addiction, is covered under the Affordable Care Act (ACA) – making attending alcohol rehab more affordable.

What is Alcohol Rehab?

Alcohol rehab is a structured program designed to help individuals overcome their addiction to alcohol and achieve sobriety. These programs typically provide a combination of medical, psychological, and social support aimed at addressing the physical, emotional, and behavioral aspects of alcohol addiction.

The length of alcohol rehab programs can vary in duration, intensity, and approach, depending on the individual’s needs and preferences. Some programs are outpatient-based, allowing participants to attend therapy sessions and support groups while continuing to live at home. Others are inpatient or residential programs, where individuals reside at a treatment facility for a specified period, typically ranging from a few weeks to several months.

Alcohol rehab may include the following:

- Detoxification: The first step in many alcohol rehab programs involves detoxification, during which the body is rid of alcohol toxins. This process can be medically supervised to manage withdrawal symptoms and ensure the individual’s safety.

- Therapy and Counseling: Therapy sessions, both individual and group, play a central role in alcohol rehab. These sessions address underlying issues contributing to alcohol addiction, teach coping strategies, and help individuals develop healthier behaviors and relationships.

- Medication-Assisted Treatment (MAT): In some cases, medications may be prescribed to help manage cravings, alleviate withdrawal symptoms, or treat underlying mental health conditions co-occurring with alcohol addiction.

- Support Groups: Participating in support groups, such as Alcoholics Anonymous (AA) or SMART Recovery, can provide individuals with ongoing peer support, encouragement, and accountability in their recovery journey.

- Aftercare Planning: Successful alcohol rehab programs include aftercare planning to help individuals transition back into their daily lives while maintaining sobriety. This may involve continued therapy, support group attendance, sober living arrangements, and ongoing monitoring and follow-up care.

Why Insurance Coverage is Important for Alcohol Rehab

The cost of alcohol rehab depends on the type of program, the length of the program, and other factors that will aid in sober recovery. Insurance coverage is important when seeking alcohol rehab because it makes treatment more financially accessible, reduces out-of-pocket expenses, expands treatment options, ensures comprehensive care, and helps fulfill legal requirements and parity laws aimed at promoting equitable access to treatment services.

- Financial Accessibility: Alcohol rehab programs can be expensive, especially inpatient or residential treatment options that require individuals to stay at a facility for an extended period. Insurance coverage helps make these services financially accessible by offsetting some or all of the costs associated with treatment. Without insurance, many individuals may struggle to afford the care they need, potentially delaying or forgoing treatment altogether.

- Reduced Out-of-Pocket Expenses: Even with insurance coverage, individuals may still be responsible for certain out-of-pocket expenses, such as deductibles, co-payments, or coinsurance. However, having insurance can significantly reduce these costs, making treatment more affordable and ensuring that individuals can focus on their recovery without the added stress of financial burdens.

- Expanded Treatment Options: Insurance coverage can broaden the range of treatment options available to individuals seeking alcohol rehab. With coverage in place, individuals may have access to a wider network of providers, facilities, and services, allowing them to choose the treatment approach that best suits their needs and preferences. This flexibility can increase the likelihood of finding a program that aligns with the individual’s goals for recovery.

- Comprehensive Care: Alcohol rehab often involves a combination of medical, psychological, and social support services to address the complex nature of addiction. Insurance coverage helps ensure that individuals have access to comprehensive care that addresses all aspects of their addiction, including detoxification, therapy, medication-assisted treatment, and aftercare planning. This holistic approach improves the chances of long-term success in recovery.

- Legal Requirements and Parity Laws: In many jurisdictions, there are legal requirements and parity laws mandating insurance coverage for mental health and substance abuse treatment, including alcohol rehab. These laws aim to ensure that individuals with substance use disorders receive equitable access to treatment services comparable to coverage for other medical conditions. By complying with these laws, insurance providers help remove barriers to treatment and promote equal access to care for all individuals.

7 Factors Influencing Insurance Coverage for Alcohol Rehab

Several factors can influence insurance coverage for alcohol rehab, including:

- Type of Insurance Plan: The type of insurance plan an individual has plays a significant role in determining coverage for alcohol rehab. Private health insurance plans, obtained through employers or purchased individually, often offer varying degrees of coverage for substance abuse treatment as part of their mental health benefits. The specifics of coverage, such as co-pays, deductibles, and annual limits, can differ based on the plan’s terms and conditions.

- Policy Terms and Conditions: The specific policy terms and conditions outlined in an individual’s insurance plan dictate the extent of coverage for alcohol rehab services. These terms may include limitations on the number of treatment sessions, requirements for pre-authorization or referrals, and exclusions for certain types of treatment or providers. It’s essential for individuals to review their insurance policies carefully and understand the details of their coverage.

- State Regulations: Insurance coverage for alcohol rehab can be influenced by state regulations and mandates governing mental health and substance abuse treatment. Some states have enacted laws that require insurance companies to provide coverage for substance abuse services, including alcohol rehab, as part of essential health benefits. These regulations can vary from state to state and may impact the level of coverage available to individuals.

- Level of Care Required: The level of care required for alcohol rehab, such as outpatient, intensive outpatient, partial hospitalization, or residential treatment, can affect insurance coverage. While many insurance plans cover a range of treatment options, including both outpatient and inpatient services, the specifics of coverage may vary based on medical necessity assessments and the individual’s treatment needs.

- Network Providers: Insurance coverage may be influenced by the network of providers and facilities included in an individual’s insurance plan. In-network providers typically have contracted agreements with insurance companies, resulting in lower out-of-pocket costs for covered services. Out-of-network providers may still be covered by insurance but may result in higher costs for the individual. It’s essential for individuals to verify whether their preferred rehab facilities and providers are in-network with their insurance plan.

- Co-occurring Conditions: Individuals with co-occurring mental health conditions, such as depression, anxiety, or post-traumatic stress disorder (PTSD), may require integrated treatment for both alcohol addiction and underlying mental health issues. Insurance coverage for alcohol rehab may be influenced by the presence of co-occurring conditions and the need for comprehensive, dual-diagnosis treatment.

- Prior Authorization and Utilization Review: Some insurance plans require prior authorization or utilization review for alcohol rehab services to ensure medical necessity and appropriate utilization of resources. These processes may involve submitting treatment plans, assessments, and progress reports to the insurance company for approval. Failure to obtain prior authorization or comply with utilization review requirements may result in denial of coverage or limited reimbursement for services.

Getting Help Verifying Insurance Coverage for Alcohol Rehab

Alcohol use disorder is serious and requires comprehensive treatment for long-term recovery – but figuring out what insurance covers can be more overwhelming than going through the steps. Southeastern Recovery Center understands that, and our first step in helping your recovery is to verify your insurance benefits for you – explaining clearly what is covered, what is not, and what you can expect your out-of-pocket expenses will be. If you or someone you love is considering alcohol rehab, give us a call today to get started with our insurance verification process and learn more about how we can help you reach your sobriety goals.